Digitalization, AI and renewable energy top themes for global investors

Energy security, an ageing population, electric vehicles and battery storage round off the top trends.

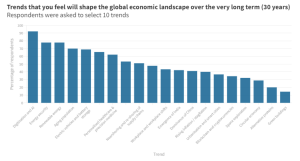

Digitalization, artificial intelligence and renewable energy are the top investment trends for global institutional investors, pension funds and family offices who consider these sectors as key to shaping the world economy over the next three decades, Invest corp. has said.

Energy security, an ageing population, electric vehicles and battery storage are also among the top investment mega-trends, according to Bahrain-based alternative asset manager’s third annual What’s Next? Investment Trends for the Future report.

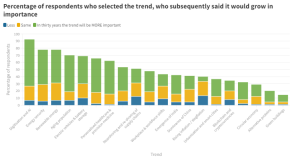

About 92 per cent of global investors ranked digitalization and AI as the leading investment themes, followed by 77.8 per cent who cited renewable energy and energy security, 70 per cent who mentioned ageing populations and 68.9 per cent who highlighted electric vehicles and battery storage, the survey showed.

Invest corp. conducted the global survey in partnership with IMD Business School to gauge the sentiment of institutional investors and explore the economic trends driving investment allocations.

The survey maps the wider demographic, resource, technological, environmental and geopolitical factors that are driving the global economy and what that means for current and future investment opportunities.

“It is clear that for global investors, digitization and AI is a key trend that will shape the global economic landscape over the long term and our data suggests that companies that leverage leading-edge technologies for solving universal or critical problems are going to be as highly investible in the decades to come, as they have been in recent years,” co-chief executive Rishi Kapoor said.

“Even though the sector has had a very difficult year, it remains an attractive investment domain today, and investors surveyed believe it will ride out the current macroeconomic storm.

“This provides some hope and opportunity for growth capital and investors that predominantly invest in the technology space.”

Investments in digital transformation across the Middle East, Turkey and Africa region are projected to surpass $74 billion by 2026, helping organizations to achieve long-term stability and growth, a study by the International Data Corporation said.

Spending on such initiatives is expected to grow at a compound annual rate of about 16 per cent over a five-year period through 2026, and would account for more than 43 per cent of total information and communications technology investments, the US research company said last month.

More than eight in 10 major global institutional investors said they were currently investing in this sector or would do so in the future.

In terms of renewables and decarbonization, Invest corp. has “strong conviction in this space as we see a market with increased demand and supply issues, potential for huge innovation and a favorable regulatory backdrop”, said co-chief executive Hazem Ben-Gacem.

Capital investments in renewables are set to outstrip oil and gas projects for the first time in 2022 as high power prices prompt countries to further diversify their energy mix, Rusted Energy said in a report in October.

The level of capital investment in the sector has increased “significantly” and is set to reach $494 billion in 2022, outstripping upstream oil and gas at $446 billion for the year, the Norway-based consultancy said.

Energy security was a key theme for investors surveyed in both Europe and the US, given the continuing Russia-Ukraine war that drove up the prices of oil, gas and other commodities in 2022, said Invest corp.

“It has now become an imperative for western markets to invest in domestic energy production to strengthen and ensure its own energy security,” the report said.

“Survey data suggests that investors anticipate the energy security theme to continue well beyond the current conflict and believe it will lead to opportunities to invest in domestic energy production in Europe and beyond.”

Global investors are more divided across regions on the other megatrends shaping the world economy.

For example, a number of European and Asian investors — most probably driven by Japanese and Chinese investors — are concerned with the trend of an ageing population, while this is less of a concern for the US and Middle Eastern regions due to their younger population, the report said.

For both Europe and Asia, investment into health care is “one of the more obvious investment opportunities” to engage with this long-term trend.