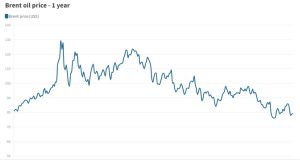

Oil prices rise but headed for a weekly loss amid demand concerns

OPEC+ could meet before June 4 for more output cuts as demand concerns continue to weigh on markets

Oil prices rose on Friday but are heading for a weekly loss as demand concerns continue to weigh on the market amid signs of a global economic slowdown.

Brent, the benchmark for two thirds of the world’s oil, was trading 2.06 per cent higher at $80.31 a barrel at 6.26pm UAE time, while West Texas Intermediate, the gauge that tracks US crude, was up 1.93 per cent at $75.09 a barrel.

“Oil is trying to rally but demand concerns are keeping the gains small,” said Edward Moya, senior market analyst at Oanda.

China, the world’s top importer of oil, is re-opening its economy after abandoning its zero-covid policy to curb the spread of the coronavirus pandemic last month, helping oil prices to surge.

However, infections continued to rise in the world’s second largest economy with many countries asking Chinese travellers to take a Covid test before leaving the country.

“With Covid spreading so rapidly throughout the country, it’s likely there’s going to be disruption at the very least that will hamper economic activity and demand,” said Craig Erlam, a senior market analyst at Oanda.

He, however, expects the scenario to change in the second half of the year. “[The] economic rebound could fuel more demand for crude and see prices rise once more,” he said.

In October, the International Monetary Fund cut its growth forecast for the world economy in 2023, amid

the Ukraine conflict, broadening inflation pressures and a slowdown in China.

The fund projects the world economy to expand 2.7 per cent this year — 0.2 percentage points lower than the July forecast.

“But beyond Q1 [first quarter], the macro conditions for oil markets still appear bullish to us. In particular, supply looks to be defined by constraint rather than availability in 2023.”

The latest data from the US-based Energy Information Administration is also weighing on oil prices. The data showed 7 million barrels were added to commercial storage for the week that ended on December 30.

However, gasoline inventories fell by about 300,000 barrels, while distillate inventories including diesel and heating oil dropped by 1.4 million barrels.

“The EIA crude oil inventory report was mixed but one of the big takeaways that it showed demand is falling off a cliff,” Mr Moya said.

The OPEC+ supergroup, consisting of Saudi Arabia, Russia and other countries, is cutting production by 2 million barrels per day on demand concerns but can “meet any time if prices aren’t going the way they want”, US-based energy company Tellurian said on Friday.

The group “could meet before June 4 for more output cuts, which may be sooner rather than later”, it said.

The possibility of OPEC+ stepping in to “prevent what they view as a disorderly sell-off” can’t be ruled out, Mr Bell said.

“Any intervention may even come unilaterally on the part of Saudi Arabia to stop oil prices dropping too quickly,” he added.

OPEC and its allies will remain “proactive” as global oil markets face uncertainty, Saudi Arabia’s Energy Minister said last month.

“In face of a wide range of uncertainties, OPEC+ has no choice but to remain proactive and pre-emptive, and this is not an easy task, especially that the market has the tendency to overreact to news in both directions,” Prince Abdulaziz bin Salman said in an interview with official news agency SPA.

Emirates NBD forecasts Brent and WTI prices to average $105 per barrel and $95 per barrel, respectively, this year.

A deep and damaging recession or China showing an inability to manage to live with Covid-19 would represent substantial downside risks for prices, according to Mr Bell.

“But in that circumstance, we would expect to see OPEC+ intervention via cutting output to help support prices,” he said.

“On the upside, given that we see limited positive surprises for supply, a better-than-expected improvement in China’s economy or softer-than-feared recession could mean oil prices at a much higher trajectory given there are so few safeguards available in the market.”